Domestic Violence isn’t just physical violence. Domestic violence relationships cycle. Different phases of the domestic violence cycle work together to exert total dominance and control over the other partner. One of the most easily forgotten and misunderstood behaviors in a domestic violence relationship is financial abuse.

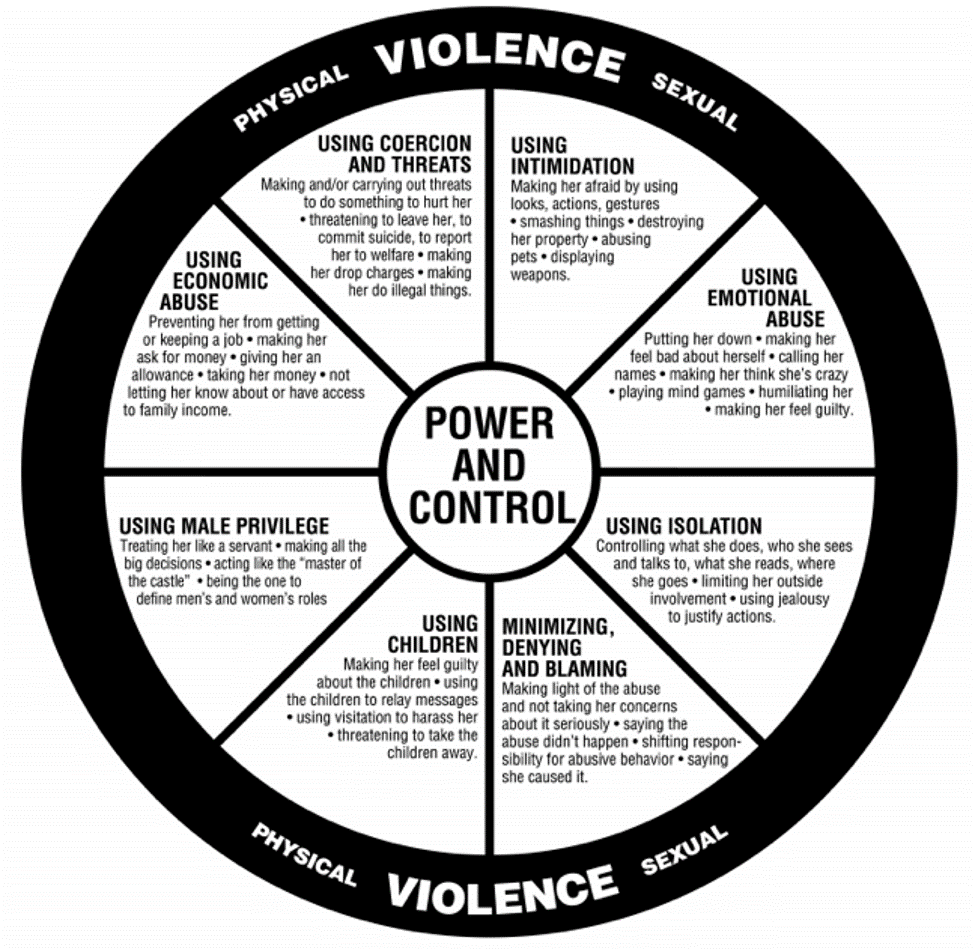

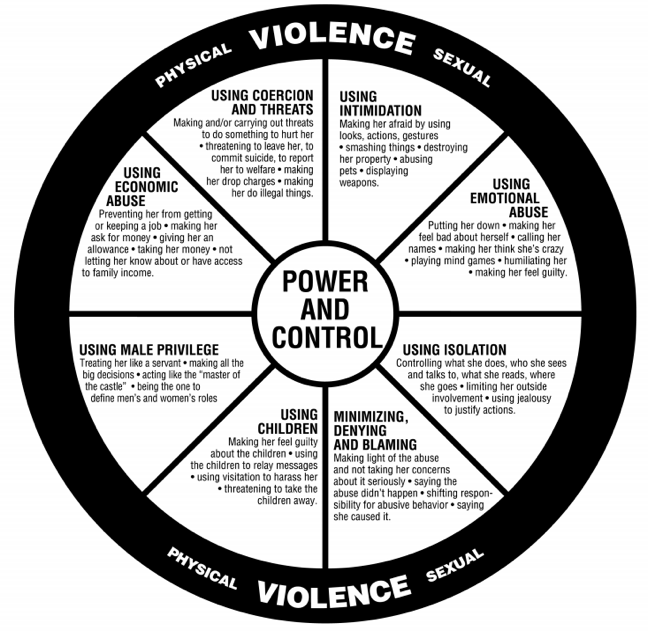

The Domestic Abuse Intervention Program, based out of Duluth, Minnesota, publishes a “Power and Control Wheel”, created by Ellen Pence and Michael Maymar. Batterer Intervention Specialist Scott Miller explains that batterers often take control of all household money and financial decisions to isolate and control their partners. After leading batterer rehabilitation groups, Miller has learned that batterers believe “Money is power, and if you control the money, you control the household.” Financial abusers can exploit their partner even if the abused partner is the primary breadwinner by exerting control over the debit cards and checkbook.

Economic Abuse can take many forms, like:

- Preventing the battered partner from getting or keeping a job

- Giving the battered partner an allowance

- Forcing the battered partner to ask for money for necessities

- Not letting the battered partner have access to family income

- Not allowing the partner’s name to be included on important documents such as the deed to a house or on the title to a vehicle.

If you think you might be in an abusive relationship, take steps to create financial independence.

- Avoid using credit and debit cards that enable your partner to track your whereabouts.

- Keep personal and financial records in a safe location. Leaving copies of important documents with a trusted friend, relative, or in a bank safety deposit box.

- Compile an Emergency Evacuation Box with copies of your family’s important records like birth certificates, social security cards, insurance cards, titles and registrations for cars, income tax returns, bank statements, and government IDs.

- Keep copies of car and house keys, extra money, and emergency phone numbers in a safe but readily accessible location.

- If you are using the internet to explore options on how to regain financial independence or how to get out of an abusive relationship, use public computers or incognito tabs to ensure your partner cannot trace your activities.

- Take a financial inventory, listing assets and liabilities, such as debt.

- If your partner controls the finances in the household, looks for ways to discretely learn more about his or her financial income, property, real property, and debts.

- If you are considering leaving the relationship, calculate what it was cost to live on your own and consider starting to set aside your own money in a safe place, even if it’s just a few dollars of each paycheck.

- Open a bank account at a different bank in your name only.

- Get a post office box and direct mail to that location.

Contact Us Today

Additionally, if you are considering leaving an abusive relationship, reach out to an attorney to learn what other steps you can take to best protect yourself and your loved ones.

You don’t have to live like this. We can help.

This blog was written by Senior Law Clerk Sarah Crane and edited by Margaret Held.